Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

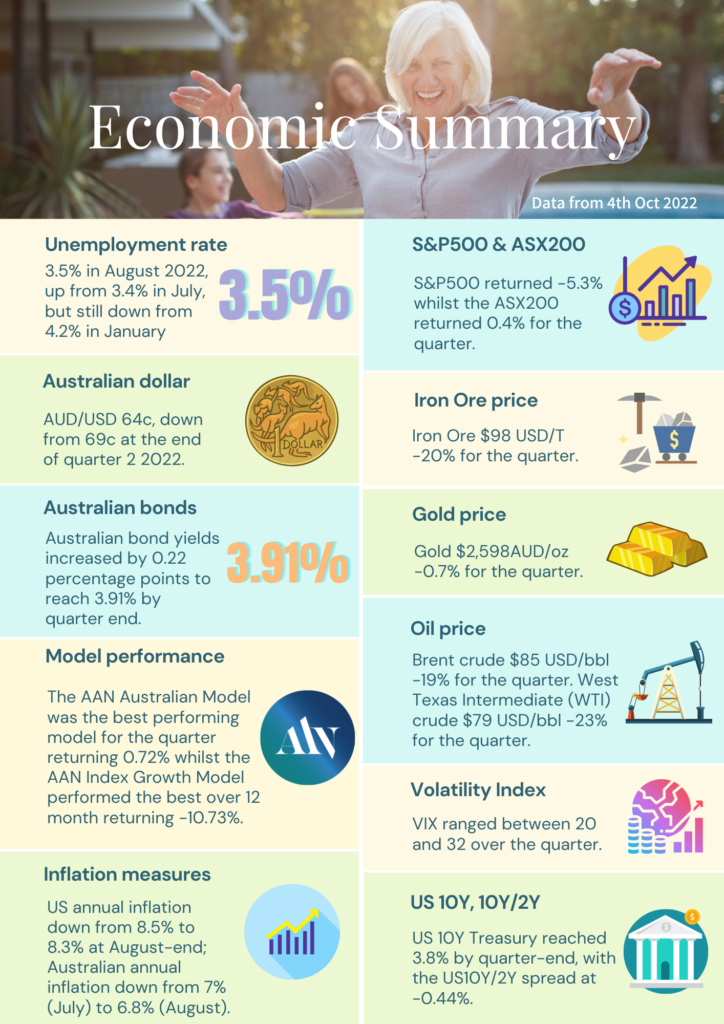

Inflation, a stronger USD, and central bank interest rate hikes impacted most markets over the September quarter. The US Federal Reserve was the catalyst for much of this as inflation became stickier and the Fed became more hawkish. The scale and breadth of drawdowns across asset classes were severe.

Few asset classes added value this quarter. Cash, Australian equities, and hedge funds were the place to be over the three-month period. However, during the month of September only cash performed positively, in part due to the inflation data releases and central bank hikes, led by the US Fed.

Changes to the model portfolios during the quarter were largely confined to re-weightings back to the benchmark allocations, with the exception of several adjustments to the Index models. Additional work is being carried out on specific underlying managers for potential inclusion in the Core, Growth, Sustainable Growth and Australian models.

Macroeconomic factors have been the dominant driver of investment market movements over the September quarter.

Inflation is on everyone’s mind at the moment. The longer it stays this way, the more persistent and elevated inflation will be. Part of inflation is essentially a self-fulfilling prophecy. Fed Chair, Jerome Powell, quoted former Fed Chairs, Paul Volcker and Alan Greenspan, on this point at the Jackson Hole economic policy symposium in late August:

“Inflation feeds in part on itself, so part of the job of returning to a more stable and more productive economy must be to break the grip of inflationary expectations.” – Paul Volcker (1979)

“For all practical purposes, price stability means that expected changes in the average price level are small enough and gradual enough that they do not materially enter business and household financial decisions.” – Alan Greenspan (1989)

Setting the public’s expectations of inflation over time was one of the historical lessons that Powell pointed out at Jackson Hole. There were two other lessons: (1) central banks can and should take responsibility for delivering low and stable inflation; and (2) central banks must keep at it until the job is done.

Powell sums up the sentiment of the Federal Open Market Committee (FOMC) by saying that “while higher interest rates, slower growth, and softer labour market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.” Some similarities to Mario Draghi’s “whatever it takes” speech in 2012

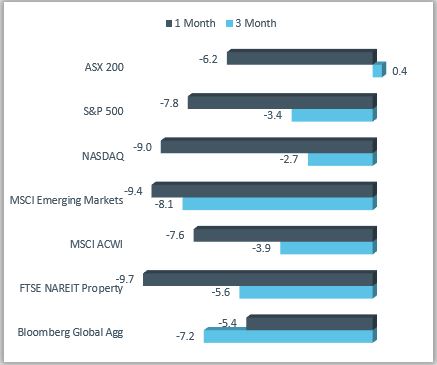

Figure 1: Market Returns to 30 September (Source: FE)

The focus is on management of the economic pain, not avoidance of it.

The headline annual inflation rate in the US was published in mid-September, down from 8.5% (July) to 8.3% (August). Core inflation accelerated from 5.9% (July) to 6.3% (August). Markets did not respond well (Figure 1). Markets expected a larger fall in headline inflation and a smaller increase in the core inflation rate. Inflation is becoming more entrenched.

The hawkish tone from Jackson Hole in August flowed through to the FOMC meeting in late September. The FOMC is “highly attentive to inflation risks” and “anticipates that ongoing increases in the target range will be appropriate”. The outcome of the meeting was a 75bps increase to the federal funds rate, up to a range of 3.00% – 3.25%.

The guidance offered, (based on information at the time) from the FOMC meeting also showed that 12 out of 19 members expect the Fed Funds rate to be between 4.5% and 5% by the end of 2023. Financial conditions are likely to be tighter for longer.

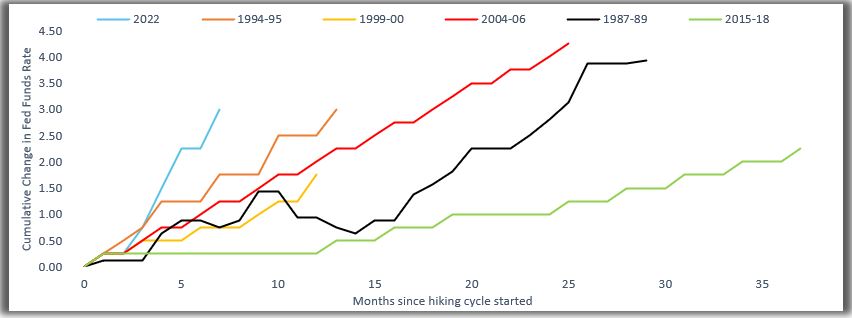

To give you some perspective of the speed at which the Fed is increasing rates, Figure 2 shows the steep increase in 2022 compared to five other hiking periods since 1987.

Figure 2: Speed of Historical US Federal Fund Hikes (Source: BIS.org)

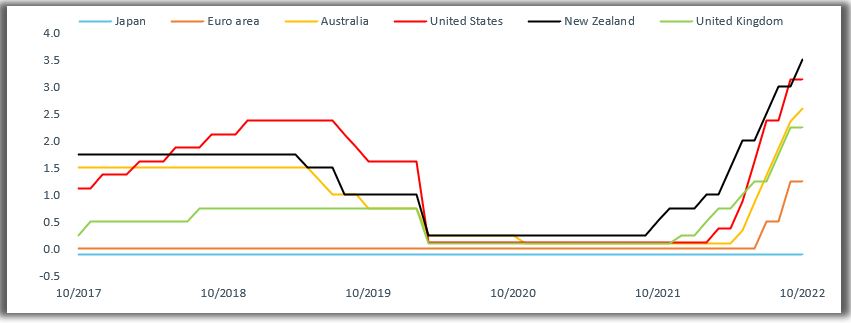

The Fed is not isolated in hiking, other central bank cash rates are shown in Figure 3. The European Central Bank increased its deposit facility rate by 75 bps in September (following the 50 bps in July), with inflation forecast to be >5% p.a. through 2023. The UK raised rates by 50bps, up to 2.25% as inflation fell slightly to 9.8% p.a. New Zealand and Australia increased rates post September-end, with New Zealand more hawkish out of the two Antipodean central banks. Japan is yet to increase rates, swimming against the global tide, with annual inflation moving to a 30-year high of 3% in August.

Figure 3: Central Bank Cash Rates (Source: BIS.org)

The ability for central banks to pull inflation back down to say 4%, is still well above a target rate of 2%. Caution is required when assessing the latest inflation data because it is a lagging indicator. Over the next few months, the labour market and wage growth will be important to watch to assess any upward pressure on inflation.

With a higher probability of interest rates remaining elevated for longer, it will be harder for those countries or corporates with higher debt levels to plough through the tempest. Pressure is building. We are seeing the market switch from inflation conversations to growth conversations. In other words, now that inflation and interest rates are more likely to remain elevated, the likelihood of damage to economic growth is higher. The seriousness of this damage will differ across the globe.

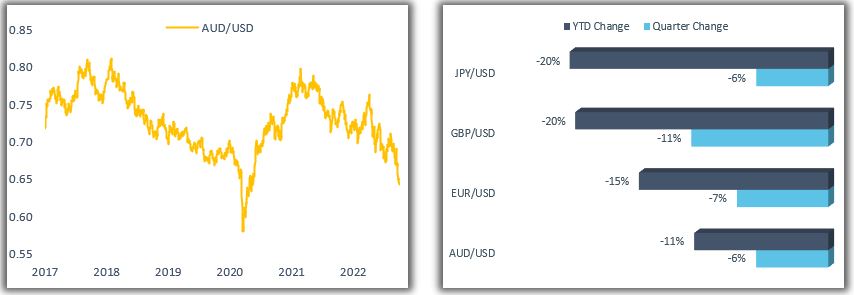

Higher rates in the US and broader risk aversion saw further strength in the US dollar through the September quarter. This has caused investors to explore hedged versions of their equivalent unhedged global equity fund exposure. The Australian Dollar (AUD) weakened from 0.69c down to 64c during the September quarter. Exchange rates are notoriously volatile, but to gain some sort of perspective, the average daily AUD/USD exchange rate since 2008 has been approximately 0.83c, which compares to 0.77c since 2000, and 0.76c since 1990. The following figures show the movement of the Aussie dollar against the US dollar since 2017, as well as the depreciation of different currencies against the USD.

Figure 4: US dollar strength (Source: BIS.org)

The energy crisis in Europe remains a major concern as the northern hemisphere winter approaches. The Russia/Ukraine war has already resulted in severe human and economic hardship. European governments have moved swiftly to bring some certainty to energy supply and reduce the chance of a worst-case economic scenario. Gas supply from Russia before the war was around 40% but has fallen to just 9% of Europe’s gas supply. The price of natural gas spiked to 340 EUR/MWh in late August before falling back to 189 EUR/MWh by quarter-end. To provide some perspective, in the 10 years before late 2021, the price of natural gas had not risen above 30 EUR/MWh.

Higher energy prices are a drag on company operations, to say the least. Highly targeted fiscal support may be necessary to ensure the ‘drag’ on economic activity doesn’t develop into longer lasting damage and a country’s most vulnerable don’t suffer. However, it is a difficult balancing act given some countries are more indebted than others. Fragmentation risks are higher. Energy security and decarbonisation will continue to dominate pursuits over the coming months.

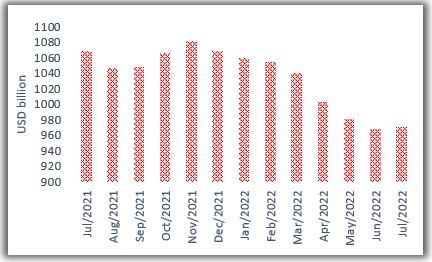

Figure 5: China, Total US Treasury Holdings (Source: Treasury.gov)

Growth in China continues to slow following the harsh zero-COVID policy and property sector slowdown. Chinese exporters face a tough period as global demand slows amidst tighter financial conditions. Year-on-year Gross Domestic Product (GDP) growth fell from 4.8% in quarter 1, down to 0.4% in quarter 2.

China reduced its holdings of US Treasuries for seven consecutive months until July this year. It could be to help prop up its currency but could also be to diversify away from USD assets given simmering geopolitical tensions. Total holdings are now below USD1 trillion for the first time in over a decade. Watch for the Politburo meeting in late October.

2022 has been a historic year for markets. The investment outlook is fragile as central banks walk a monetary policy tightrope, the real economy adjusts to tighter financial conditions, and geopolitics continue to threaten stability. Fundamentals matter. Investors should be taking extra care to evaluate the resilience of their portfolio in times like these.

You can download the entire Quarterly Investment Update HERE

Regards,

Marshall Brentnall, and the AAN Investment Committee

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved