Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

Our team will be signing off until early January from next Tuesday, and prior to that, I wanted to share some updates into the portfolios we manage, and to outline some changes we recently made to our active models.

Portfolio performance

Given the year that we have had, for the AAN Growth Model to be currently sitting at 13.68% for the last 12 months, and the AAN Core Model at 11.45%, is something our team are particularly happy with. Further to this, the AAN Growth Model is up 8.22% since the US election in November, which is a number many would traditionally be happy to generate over the course of twelve months, not six weeks.

These results are based on a variety of factors, including some of the decisions the Investment Committee and the underlying fund managers have made, along with market movements and momentum.

Changes

Whilst we are delighted with the performance of our models, we thought it prudent to outline to our investors what we are doing to manage risk, whilst continuing to deliver outcomes in 2021.

Over the course of the last six months the Investment Committee has undertaken a complete review of the asset allocation policies for the AAN Growth and Core models, along with a study of the managers selected managing Australian shares and fixed interest.

We have considered, researched and analysed these questions and the Investment Committee recently made the decision to;

Move to an equal weighted approach for Australian and International shares

Replace Perpetual Investments as one of our Australian share managers with Hyperion Asset Management

Specific to the AAN Core model, we moved funds from Cash to the Ardea Real Outcomes Fund, and we have replaced the index Vanguard Australian Fixed Interest ETF with the active Franklin Australian Core Plus Bond Fund.

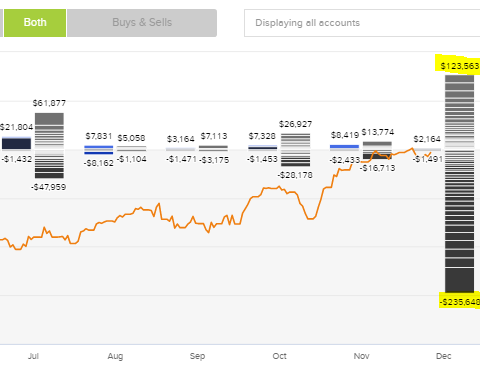

Should you log into your Praemium account now you will see that many of these changes have already been transacted, with numerous buys and sells having been actioned over the last several days. It was important to do this now, before volumes become lighter over the Xmas break.

As always we will rebalance our portfolios back to their strategic benchmarks at the end of December, as we do each quarter, however, we do not expect significant movements with this rebalance given the changes just implemented.

AAN Sustainable Growth Model

It is also with great pleasure that I share with you that we have recently launched the AAN Sustainable Growth Model for superannuation and wealth accounts. This model has been implemented to cater for investors seeking a portfolio of growth assets that aligns with their preference for sustainable investments with potential for making a positive contribution to society.

The Investment Committee has adopted a pragmatic approach to excluding sectors given the subjective nature of some exclusion criteria, and the diversity of investor views relating to ethical investments. If you would like to know more about this model or the AAN Sustainable Investment policy, please let me know.

All the best for you and your loved ones over the break, and I look forward to seeing you in 2021.

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved