Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

Each quarter the AAN model portfolios are reweighted back to their strategic benchmarks by the Investment Committee, however in our most recent end-of-quarter reweight some changes were also made to the underlying models. Some of these decisions were based on research that has been conducted over the last two quarters, and others were tactical and in response to market movements.

It has been well documented that global markets have fallen over the course of the last six weeks, which also includes movements in the value of the Australian dollar and corporate debt markets that have prompted the Investment Committee to make two tactical changes. Firstly, in the Growth and Core models the decision was made to move to a hedging level of 50%. This was to provide some downside protection to investors should the Australian dollar appreciate in value. In addition, the decision was made to de-risk some of the fixed income allocation within the Core model, by selling out of our corporate debt exposure, accessed through the BetaShares Cred ETF and allocating those monies to cash.

Continued falls in world equity markets also provided an opportunity to reduce costs across some of the index investments and that saw the Vanguard Australian Shares index replaced by the BetaShares A200. The investment in the Vanguard International Shares index fund was also split into two underly ETF’s. The primary driver behind this decision was to reduce costs, whilst providing investors with the same or very similar exposure.

Share market falls and what it means for you

As you turn on the news this evening or read your preferred newspaper online, you will be greeted with the news that markets have fallen significantly this morning. At the close of day today (9 March), the Australian share market is down 7.3%, it’s biggest single-day fall since the Global Financial Crisis. What this means in real numbers though is that many portfolios are now sitting at or around where they were in January 2019.

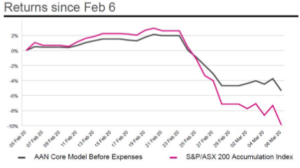

Whilst these falls are large, it is important to note that the portfolios we build for clients are diversified in terms of the assets inside them, and also the managers and investment styles we select. What this means is that as of last Friday when the broader markets were down over 11% for the last month, our Core model is only down 5.61% and our Growth model is down 8.28%.

Interestingly investors in the Core model remain up 8.94% for the last 12 months and Growth investors are up 10.25% for the last 12 months, even after factoring in these falls.

As you turn on the news this evening or read your preferred newspaper online, you will be greeted with the news that markets have fallen significantly this morning. At the close of day today (9 March), the Australian share market is down 7.3%, it’s biggest single-day fall since the Global Financial Crisis. What this means in real numbers though is that many portfolios are now sitting at or around where they were in January 2019.

Whilst these falls are large, it is important to note that the portfolios we build for clients are diversified in terms of the assets inside them, and also the managers and investment styles we select. What this means is that as of last Friday when the broader markets were down over 11% for the last month, our Core model is only down 5.61% and our Growth model is down 8.28%.

Interestingly investors in the Core model remain up 8.94% for the last 12 months and Growth investors are up 10.25% for the last 12 months, even after factoring in these falls.

It is important that when reading the headlines, you have all of the data to ensure you can better respond to negative news as for many of our clients, their portfolios are faring much better than the market and your managers are making decisions on your behalf, and we have confidence in the assets they hold.

The current market volatility is just that, volatility. Earnings and fundamentals will be impacted by a slowing world economy and frankly that was happening anyway. Quantitative easing is dropping out so markets will find a new normal and you can expect value will re-find its mojo.

This current period is a reflection of uncertainty and when the markets wake up and realise that this latest pandemic is much the same as the 2009 Swine flu and the world response has been far better organised than then, investors will start looking at earnings growth again.

To be clear, we are not trying to crystal ball this, but merely giving you some history as each of the Directors of our license (including Jeff and Marshall) have been operating in financial services and advice for more than 20 years and have seen more than their fair share of market ups and downs.

For now, please do your best to look past the headlines knowing full well that our team are here to support you, and ensure you make the right (financial) decisions in a particularly volatile and nervous period. If you have any questions or specific concerns contact your adviser.

If you would like to read our latest portfolio update click here. Should you have any questions about your portfolio, I would encourage you to email or call your adviser 02 9232 6800.

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved