Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

The 2023-24 Federal Budget focuses on providing cost of living relief through lower power bills, higher welfare payments and more support for small business and housing. Note: These changes are proposals only and may or may not be made law.

Cost of living

Eligible small businesses will receive a credit of up to $650. The amount of the credit will vary depending on the location, with no further details revealed in the Budget.

The change will save general patients up to $180 a year per subsidised prescription. Concession card holders are expected to save up to $43.80 a year per medicine.

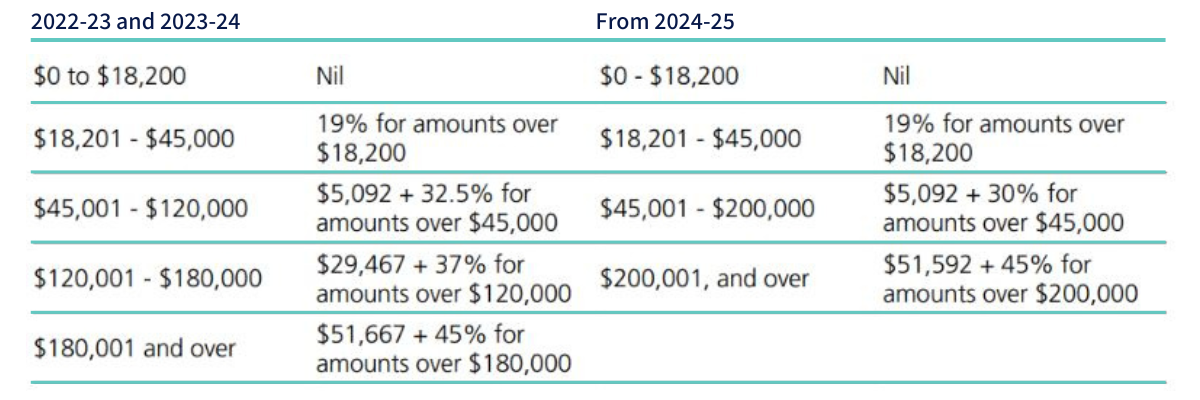

Personal taxation

With nothing new announced in this year’s Federal Budget regarding the stage 3 tax cuts, they remain legislated to take effect on 1 July 2024. However, it’s worth noting that there is more than a year, and a further Federal Budget, between now and commencement.

This means low-income earners will be able to earn more income before being liable to pay Medicare levy.

The following table compares the level of taxable income below which no Medicare Levy is payable.

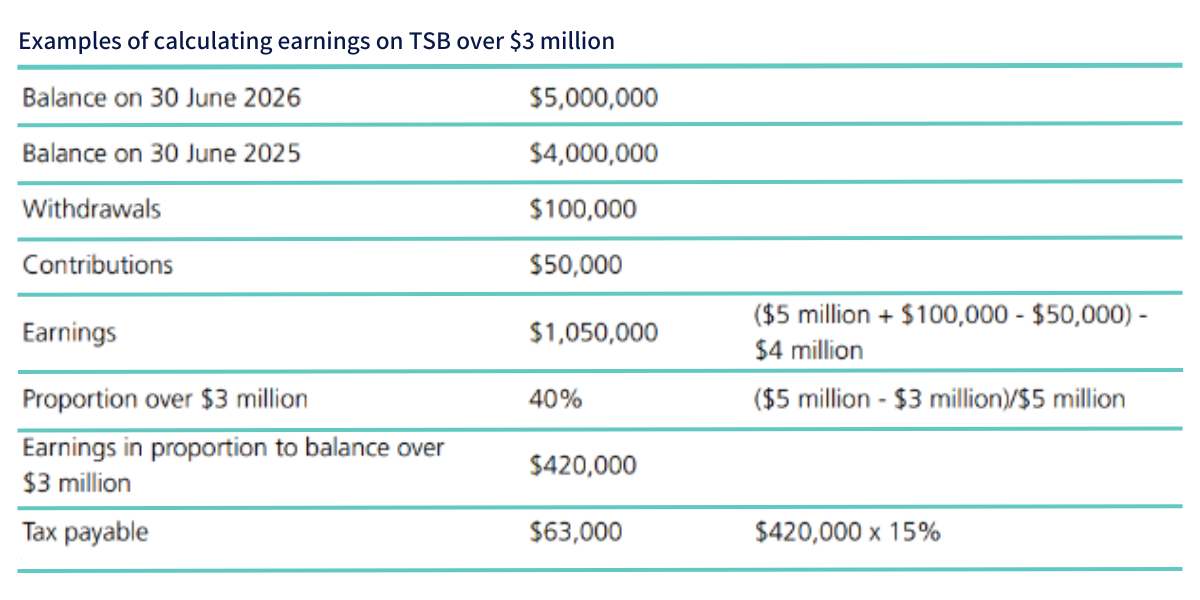

Superannuation

Small business support

Small and medium businesses (those with aggregated annual turnover of less than $50 million), will be able to deduct an additional 20% of the cost of eligible depreciating assets that support electrification and more efficient use of energy.

Up to $100,000 of total expenditure will be eligible for the incentive, with the maximum bonus tax deduction being $20,000 per business.

Eligible assets or upgrades will need to be first used or installed and ready for use between 1 July 2023 and 30 June 2024. These will include assets that upgrade to more efficient electrical goods such as energy efficient fridges, assets that support electrification such as heat pumps and electric heating or cooling systems, and demand management assets such as batteries or thermal energy storage.

Small businesses can instantly write off multiple assets as the $20,000 threshold will apply on a per asset basis.

Improved aged care support

From 1 July 2022

The government will provide additional funding over 5 years from 2022–23 to continue to improve the delivery of aged care services and respond to the Final Report of the Royal Commission into Aged Care Quality and Safety. Funding includes:

This measure extends the 2022–23 October Budget measure titled Implementing Aged Care Reform

Pay rise for aged care workers

From 1 July 2023

Severe staff shortages in the aged care sector, largely been driven by low wages, may abate a little with the government’s commitment to fund a pay rise.

More than $11 billion has been allocated to support an interim 15 per cent increase in award wages.

The increase will benefit 250,000 people including registered nurses, enrolled nurses, assistants in nursing, personal care workers, head chefs and cooks, recreational activities officers (lifestyle workers), and home care workers.

Social security

The Government will provide $1.9 billion over 5 years (and $0.5 billion per year ongoing) to extend eligibility for Parenting Payment (Single) to support single principal carers with a youngest child under 14 years of age. The existing eligibility provides support to single principal carers with a child aged under 8 years of age.

In addition, the Government will abolish ParentsNext from 1 July 2024 and develop a replacement voluntary program, to provide high-quality pre-employment support. This will end the risk of losing payments and take away unnecessary stress and anxiety from participants, who are mostly women and single parents.

Cheaper childcare commences in July. Legislated measure to take effect from July 2023 .

The government has re-announced their commitment to a previously legislated measure(3) aimed at providing more affordable childcare. The measure, which was legislated in November 2022, will commence from July 2023. The government says around 1.2 million families will begin to benefit from cheaper childcare. Child Care Subsidy rates will increase up to 90 per cent for eligible families and up to 95 per cent for any additional children in care aged 5 years and under.

For families earning over $80,000, the subsidy rate will taper down by 1 percentage point for every additional $5,000 of family income until the subsidy reaches 0 per cent for families earning $530,000.

A more flexible and generous Paid Parental Leave scheme will also be introduced in July. A new family income test of $350,000 per annum will see nearly 3,000 additional parents become eligible for the entitlement each year.

Housing assistance

Eligibility for the Family Home Guarantee is also expanding to include eligible borrowers who are single legal guardians of children such as aunts, uncles and grandparents.

The number of guarantees available and other eligibility criteria are unchanged.

Contact advice@evalesco.focusedgrowth-dev1.com.au or your Personal Financial Adviser to discuss any part of this year’s Federal Budget and how it may impact you.

Information in this article has been sourced from the Budget Speech 2023-24 and Federal Budget Support documents.

It is important to note that the policies outlined in this publication are yet to be passed as legislation and therefore may be subject to change.

Sources

(1) Family Assistance Legislation Amendment (Cheaper Child Care) Bill 2022

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved