Schedule a Chat

Contact Info

Suite 17.03, Level 17

20 Bond Street

Sydney NSW 2000

INSIGHTS WITH EVALESCO

TOPICS DISCUSSED

Persistent inflation has seen a series of rate hikes from the central banks of developed countries around the globe. Whilst headline inflation has reduced across several regions, core inflation measures remain above target inflation rates for central banks.

There are four primary reasons driving price increases: a decline in competition, rising marginal costs, reduced price-elasticity of demand, and unexpected demand. The post-pandemic demand shock arose from unexpected demand, a result of fiscal policies and pent-up spending. Additionally, an aging population, coupled with social security being tied to the Consumer Price Index, results in increased inflationary pressure. Moreover, higher government spending, alongside demands for public services and global challenges, will likely enhance inflation.

Economies

U.S. core inflation on the path to normalisation

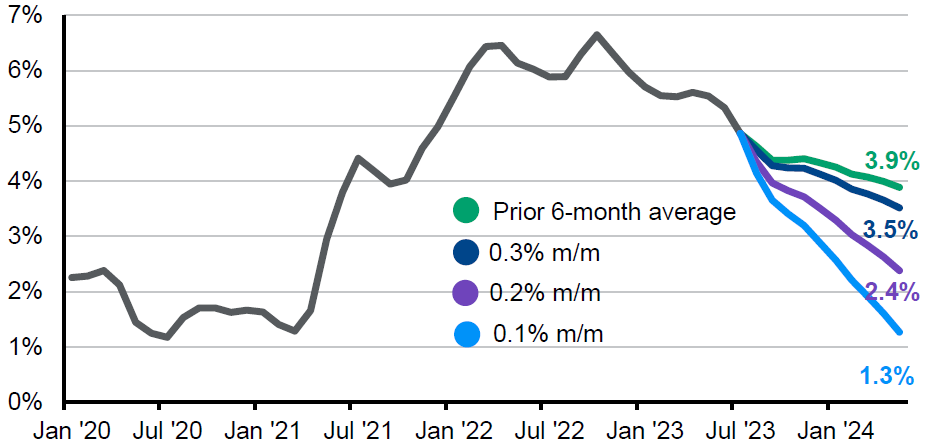

Scenarios for core inflation based on various monthly inflation rates

Source: JPMorgan Asset Management

Softer U.S. labour and inflation data in July might deter the Fed from hiking rates in September. The slow inflationary path raises concerns about its pace for the Federal Reserve. Despite economic activity, the possibility of rate hikes remains, with rate cuts potentially delayed until 2024. Markets appear optimistic about the U.S. economic outlook due to robust equity performance. Investors should be cautious with their expectations for equity returns and bond yield trends in a prolonged higher-rate environment.

The Federal Reserve indicated that recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated. The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5.25 to 5.5%.

China’s economic activity surged with its reopening but has since faltered, recent PMI figures highlights some concerns in various sectors like property and employment. The government’s attempts at stimulus and cost-reducing measures for firms may offer limited impact due to already low lending rates. Diplomatically, high-level talks between the U.S. and China, exemplified by Antony Blinken’s Beijing visit and potential meetings between Presidents Biden and Xi, suggest a renewed focus on dialogue. However, escalating military tensions, defence deals, and regional expansions hint at long-term confrontations between the two superpowers.

The Chinese real estate crisis remains unresolved and faces an intensifying crisis, with major developers like Evergrande and Country Garden grappling with significant financial challenges. Evergrande, having previously defaulted and accruing over $300bn in liabilities, recently filed for bankruptcy protection in New York. Meanwhile, Country Garden, previously China’s top property developer by revenue, risks default, particularly after missing bond payments. The downturn in the sector has resulted in unpaid suppliers and stranded homebuyers, with new home sales plunging. The instability threatens to ripple into China’s broader economy and affect international investors, as China attempts to bolster its weakening economy and restore confidence in its markets

|

“The future is never clear, you pay a very high price in the stock market for a cheery consensus.” – Warren Buffett |

In its October 2023 meeting, the Board of the Reserve Bank of Australia (RBA) decided to leave the cash rate target unchanged at 4.10% and the interest rate paid on Exchange Settlement balances unchanged at 4.00%.

Interest rates have been increased by 400 percentage points since May last year. The higher interest rates are working to establish a more sustainable balance between supply and demand in the economy and will continue to do so. In light of this and the uncertainty surrounding the economic outlook, the Board again decided to hold interest rates steady this month. This will provide further time to assess the impact of the increase in interest rates to date and the economic outlook.

The RBA noted in its August update that Australia’s economic growth has recently slowed, influenced by higher interest rates, increased living costs, and decreased household wealth, but it is expected to pick up pace as these challenges lessen over time. Meanwhile, the revised population growth estimate mainly impacts recent quarters.

Markets

The Australian labor market is robust with solid employment growth in the March quarter, and the recent surge in overseas migration may be addressing labor shortages. However, the unemployment rate may rise in the coming years due to the dampened economic growth.

Several uncertainties loom over Australia’s economic outlook, such as the conflicting factors impacting household spending and global growth. Factors include the balance between labor demand and rising inflation, potential changes in global monetary policy, and the stability of the banking sector which could significantly affect the global economic landscape if it deteriorates.

US equity market performance since the start of the year was driven by a narrow set of mega cap technology stocks and continues to be.

Towards the end of the September quarter, Apple dropped well below the $3 trillion mark, falling to US$2.66T value, on the back of Chinese bans on the use of iPhones by public servants. Apple has still generated a 12-month performance of 19.80% to September 2023. The next largest company, Microsoft, is now US$300B smaller than Apple, but has generated 32.06% for the 12 months to September 2023. Nvidia has been a stellar performer generating 252.61% for the same period. The Technology and Artificial Intelligence thematics continue to captivate investors, though investors should be cognisant of how much any future growth has already been priced into these stocks.

Australian large caps sold off hard in September, down 2.8% for the month. Mid-caps and small-caps did even worse than blue chips, with the S&P/ASX MidCap 50 and the S&P/ASX Small Ordinaries plunging 4.6% and 4.0%, respectively, in September.

Markets, stocks, and bonds have been dropping in price in recent weeks as investors prepared for the prospect that central bankers will hold interest rates “higher for longer” than previously expected, to try to squeeze inflation out of global economies. The months of September have seen stocks heading for their worst month of the year as a triple whammy of soaring bond yields, rising oil prices and slowing growth, trigger a widespread sell-off, even in mega-cap tech companies.

What’s next?

The Australian economy has displayed resilience amidst global challenges, with commodity prices and trade relations between Australia and China remaining stable. Consumer spending has been subdued but not calamitous, thanks to the buffer of COVID savings. Bank bad debts have been fewer than anticipated, and inflation and wage growth have been manageable, fuelling hopes that the Reserve Bank of Australia (RBA) might have concluded its rate hikes. However, there are looming concerns. There is an anticipated surge in wages for the upcoming quarters due to several factors like higher pay in healthcare, bank settlements, and public sector wage agreements. Additionally, the declining Australian dollar, coupled with rising oil prices, may drive inflation upwards. These combined factors hint that the RBA might have to introduce further rate hikes.

High inflation and central bank actions remain the dominant drivers of market movements. Q3 2023 has seen central banks generally taking the same direction, pausing on interest rate changes. However, the future of inflation remains uncertain with recent oil price increases leading to price increases at the bowser. One thing is a little clearer, central banks are nearing the end of their hiking cycles, and there is potential 2024 could see some interest rate decreases, albeit modest compared to the rate of increase. Central bank interest rate targets will remain a key focus and with no clear direction at present, volatility across markets is expected to remain present.

You can download the entire Quarterly Investment Update HERE

Marshall Brentnall, and the AAN AM Investment Committee

SHARE OUR INSIGHTS

Share on Facebook

Share on Email

Share on Linkedin

NEWSLETTER

Evalesco Financial Services Level 17, 20 Bond Street Sydney NSW 2000

Phone: (02) 9232 6800

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Evalesco Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance. Copyright © 2019 Evalesco Financial Services. All rights reserved